Strategy’s Bitcoin Yield Climbs Over 12% YTD On $555 Million Acquisition Spree | US Crypto News

Welcome to the US Morning Crypto News Briefing—your mandatory rundown of the supreme tendencies in crypto for the day ahead.

Rob a coffee to perceive what consultants roar about Bitcoin’s (BTC) value amid recovery efforts. The scheme of Bitcoin as a hedge against inflation and financial uncertainty is step by step becoming questionable, with institutional impact including to the worries.

Can Strategy’s $555 Million BTC Have Send Bitcoin Past $90,000?

Michael Saylor, the chairman of Strategy (previously MicroStrategy), revealed the firm’s most up-to-date Bitcoin buycomprising 6,556 BTC tokens value approximately $555.8 million. With this, the firm has attained a Bitcoin yield of 12.1% 12 months-to-date (YTD) in 2025.

“MSTR has bought 6,556 BTC for ~$555.8 million at ~$84,785 per bitcoin and has executed BTC Yield of 12.1% YTD 2025. As of 4/20/2025, Strategy holds 538,200 BTC bought for ~$36.47 billion at ~$67,766 per bitcoin,” Saylor shared.

Strategy uses the Bitcoin Yield YTD to measure the BTC holdings per portion amplify. This mannequin has been a key section of their monetary approach firm since their first Bitcoin buy in August 2020.

This acquisition aligns with a bullish market sentiment for Bitcoin, which is step by step nearing the $90,000 milestone, as the contemporary US Crypto News indicated.

Despite a delicate recovery in Bitcoin costs this week, up by over 3% in the last 24 hours, it is a long way value noting that Bitcoin is extremely gentle to financial indicators.

Equally, the world market is extremely gentle to monetary insurance policies region by major economies, in particular the US. BeInCrypto contacted Paybis founder and CEO Innokenty Isers for insights on the contemporary market outlook, in particular for Bitcoin.

“Given the sturdy concentration of traders in technology stocks, shifts in exchange insurance policies and authorities interventions that impact key indices indulge in the Nasdaq Composite form ripple effects all the scheme thru monetary markets,” Isers told BeInCrypto.

Per the Pybis govt, because the US Presidential inaugurationthe outlook of Bitcoin has modified from a trusted hedge against inflation to a more possibility-on asset.

“With its moderately increased volatilitypossibility-averse traders may per chance per chance additionally honest prefer different inflation hedges as an different of Bitcoin,” he added.

Iners expressed cognizance of the longer stretch of the exchange battle and the aptitude inflation that will emerge. Per this, he renowned that capital allocation to Bitcoin as a hedge against financial instability may per chance per chance additionally honest be lowered.

Strategy’s Stock Top price Narrows as Bitcoin Hype Cools

Meanwhile, Strategy has seen a necessary shift in its stock valuation dynamics over the past 12 months. Saylor at the moment revealed that as of Q1 2025, over 13,000 institutions and 814,000 retail accounts held MSTR without extend.

“An estimated 55 million beneficiaries own indirect exposure thru ETFs, mutual funds, pensions, and insurance portfolios,” Saylor added.

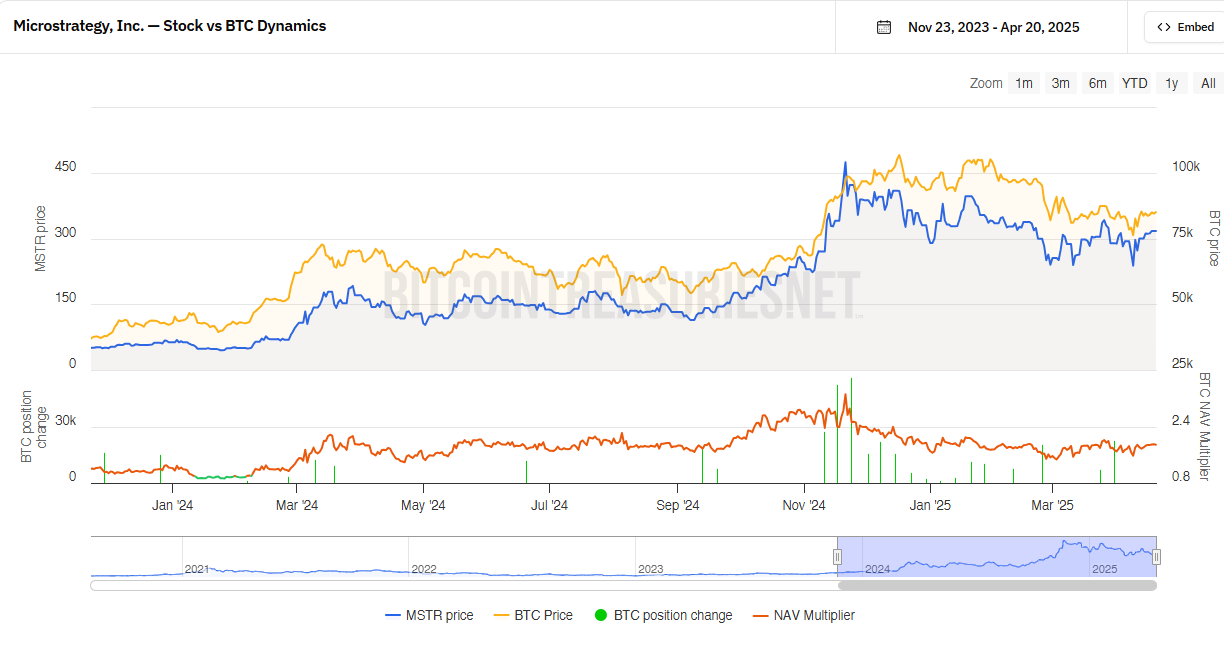

Per files on Bitcointreasuries.procure, the top price traders once paid for exposure to its Bitcoin holdings has particularly narrowed.

Particularly, the NAV multiplier, a measure of how noteworthy the stock trades above the value of Strategy’s Bitcoin resources, has reduced as in contrast with last 12 months. This implies that MSTR is now trading closer to the staunch value of its Bitcoin reserves.

In 2024, traders had been difficult to pay a noteworthy top price for MSTR shares, pushed by Bitcoin’s hype and MicroStrategy’s aggressive accumulation approach.

“I don’t know if hunting for approach equity is a respectable suggestion for the authorities. The stock would honest pump, and it’s likely trading at a top price over NAV with a increased possibility profile. Also, I judge the gov will earn it subtle to search out institutions that is at possibility of be difficult to sell their BTC in big quantities,” an analyst said at the moment.

The terrified NAV multiplier suggests a more cautious market sentiment. Analysts judge this displays a shift toward valuing MicroStrategy per its fundamentals pretty than speculative Bitcoin enthusiasm.

This implies a maturing market formula to the firm’s uncommon investment approach.

Chart of the Day

This chart shows how Strategy’s stock value (blue) strikes with Bitcoin value (orange). When Bitcoin goes up, MicroStrategy in general follows, but it certainly swings rather more.

Nonetheless, the NAV multiplier has narrowed as in contrast with last 12 months, meaning MicroStrategy’s stock is now trading closer to the staunch value of its Bitcoin holdings.

Remaining 12 months, traders paid a bigger top price for exposure to MSTR, but that hole has lowered in dimension. This implies a more cautious sentiment or a shift toward valuing the firm per fundamentals pretty than honest Bitcoin hype.

Byte-Sized Alpha

- Bitcoin ETFs noticed modest $15 million inflowsa shift from the old $713 million outflows, however the smallest influx of 2025, signaling cautious investor sentiment.

- XRP’s futures market shows a bullish shift with long positions exceeding short bets, signaling doable value increases.

- Accumulation indicators from whale exercise and consolidation at $0.60 say a doable rally for Pi Networkregardless of concerns in regards to the dearth of alternate listings and utilize cases.

- Solana surpasses Ethereum in staking market cap with $fifty three.15 billion, pushed by increased staking yield and 65% of present staked.

- Bitcoin whales gathered fifty three,652 BTC value $4.7 billion in a monthpushing the value to $87,463, but long-term holder income hit a two-12 months low.

- PlanB criticizes Ethereum as centralized and pre-minedciting PoS, tokenomicsand a flexible present as key crimson flags.

- Decentraland’s (MANA) value has surged over 10% in 24 hourshitting a two-month excessive of $0.31.

Crypto Equities Pre-Market Overview

| Firm | On the End of April 17 | Pre-Market Overview |

| Strategy (MSTR) | $317.20 | $323.49 ( 1.98%) |

| Coinbase Global (COIN) | $175.03 | $175.85 ( 0.46%) |

| Galaxy Digital Holdings (GLXY.TO) | $15.36 | $15.12 (-1.41%) |

| MARA Holdings (MARA) | $12.66 | $12.83 ( 1.34%) |

| Arise Platforms (RIOT) | $6.49 | $6.52 ( 0.54%) |

| Core Scientific (CORZ) | $6.61 | $6.59 (-0.27%) |

Disclaimer

In adherence to the Belief Mission guidelines, BeInCrypto is committed to fair, clear reporting. This news article goals to assemble moral, timely files. Nonetheless, readers are told to own a study info independently and search the advice of with a reliable before making any decisions per this whisper. Please picture that our Phrases and Instances, Privateness Coverageand Disclaimersown been up to this point.