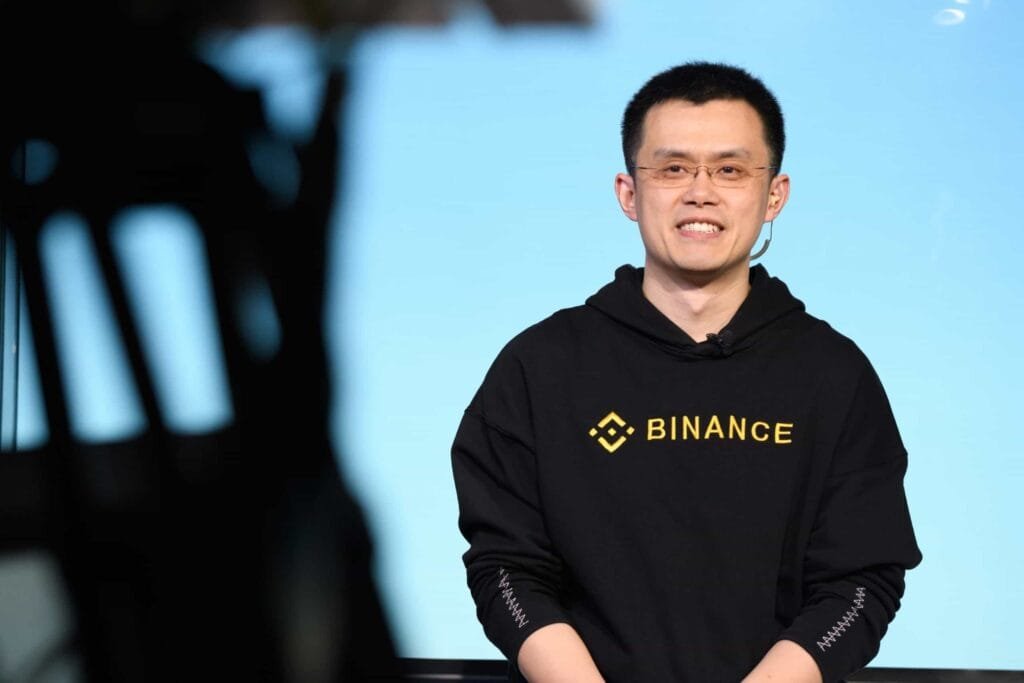

SEC and Binance Choose to Extend Legal Proceedings in Ongoing Case: What’s Next?

Of course! Please provide the article excerpt that you’d like me to rewrite

SEC and Binance Choose to Extend Legal Proceedings in Ongoing Case: What’s Next?

In an evolving narrative that grips the financial and cryptocurrency worlds alike, the U.S. Securities and Exchange Commission (SEC) has opted to extend its legal proceedings against Binance, one of the largest cryptocurrency exchanges globally. This decision adds another layer of complexity to an ongoing saga that has profound implications for investors, regulators, and the crypto market at large. In this post, we will analyze the situation, provide insights into the ramifications of this extension, and speculate on the next steps for both the SEC and Binance.

Understanding the Context

The Securities and Exchange Commission, tasked with protecting investors and maintaining orderly markets, has been scrutinizing Binance for potential non-compliance with U.S. securities laws. This legal scrutiny is not isolated; it reflects a broader trend of increasing regulatory oversight in the cryptocurrency space.

Why Did the SEC Extend Proceedings?

Several factors contributed to the SEC’s decision to prolong the legal proceedings against Binance:

- Ongoing Investigations: The complexity of the allegations against Binance, including issues related to unregistered securities and potential market manipulation, demands careful and thorough investigations.

- Public Interest: With the rise of cryptocurrency investments among retail investors, the SEC is under pressure to ensure transparency and protect investors from potential pitfalls.

- Key Legal Precedent: This case could set significant legal precedents for how cryptocurrencies are classified and regulated in the U.S., necessitating a cautious approach by the SEC.

The Broader Implications for Binance

For Binance, an extension indicates the seriousness of the allegations but also provides the exchange with a window to potentially strategize and respond effectively. The exchange has faced multiple regulations in various countries, which complicates its operational framework.

Challenges Ahead

Binance now finds itself at a crossroads, battling multiple challenges:

- Regulatory Compliance: Binance must adapt its operational model to meet the compliance requirements set forth by regulators, or risk further penalties and market share loss.

- Public Trust: The continued legal battles can erode public trust, a vital asset for any exchange, especially in the volatile cryptocurrency market.

- Operational Adjustments: The uncertainty surrounding the case may require Binance to make significant adjustments in its operations, affecting its competitive edge.

Investor Sentiment in Turbulent Times

As the legal proceedings play out, investor sentiment remains a crucial factor. The uncertainty surrounding Binance’s future can lead to:

- Market Volatility: Prices may fluctuate significantly based on news regarding the case, impacting investor decisions.

- Increased Scrutiny: Investors may become increasingly vigilant and wary, prompting a reduction in trading volume.

- Comparative Analysis: Investors may seek opportunities in competing exchanges viewed as more compliant with regulations, affecting Binance’s market position.

Looking Ahead: What’s Next?

Analyzing what lies ahead is crucial for both stakeholders and observers of the cryptocurrency market. The following predictions can be made:

- Settlement Options: It is plausible that both parties may explore settlement avenues, resulting in a resolution that could outline a clearer regulatory framework for the future.

- Policy Changes: The SEC might introduce new guidelines specific to cryptocurrency exchanges, reshaping the landscape for all players in the market.

- Investor Education: Regardless of the case outcome, the SEC may double down on its efforts to educate investors about the risks associated with crypto trading.

A Unique Perspective: The Case as a Catalyst for Change

This case is not just about one company but serves as a barometer for the entire cryptocurrency industry in the U.S. It signifies a pivotal moment wherein regulators and exchanges must navigate the complexities of evolving digital currencies.

The Role of Technology in Compliance

In a rapidly changing environment, technology will play an essential role in compliance. Blockchain analytics and other emerging technologies can help exchanges like Binance enhance transparency and prove compliance with regulatory environments. This situation may push the industry towards adopting greater technological solutions that assure both regulators and users of their commitment to compliance.

Expert Insights

Industry experts believe that this case could act as a watershed moment for how digital assets are regulated:

- Legal Education: Leading legal experts advocate for more robust legal education around cryptocurrencies to inform policy changes and regulations.

- Need for Dialogue: Prominent fintech influencers are calling for ongoing dialogue between regulators and cryptocurrency exchanges to bridge the gap between innovation and compliance.

Benefits and Value of This Discussion

Through this ongoing discussion, several benefits arise:

- Informed Decisions: Investors can make more informed decisions based on the developments in this case.

- Enhanced Regulations: A more defined regulatory framework could emerge, benefiting not just Binance but the whole cryptocurrency ecosystem.

- Growth of Trust: Transparency fostered through this regulatory scrutiny can lead to an increase in public trust in cryptocurrencies.

Concluding Thoughts

The SEC’s decision to extend legal proceedings against Binance opens new pathways for discussion, analysis, and action. As this case unfolds, it remains essential for all stakeholders to engage, educate, and prepare for a transformative future in the cryptocurrency market. The outcomes will help shape the trajectory of digital currencies, potentially establishing a framework that can accommodate innovation while providing necessary protections for investors.

For more updates on such critical topics, explore our extensive articles on Biz Tech Live and gain insights into the ever-evolving tech landscape.