Inventory Market Sinks While Crypto Market Stages a Recovery

More than 24 hours after Trump’s announcement of a comprehensive tariff utilized globally, the financial markets occupy also persisted 24 hours of intense volatility. While the stock market remains steeped in red, the crypto market has confirmed some signs of restoration.

Inventory Market Intensely Dumps after Trump’s Tariff Present

The global stock markets experienced a turbulent commence to April 2025, with indispensable declines all over predominant indices. The U.S. stock market’s capitalization evaporated by over $2.85 trillion in the morning session on my own, underscoring the severity of the downturn.

Offer: TradingView

Meanwhile, Japan’s Nikkei index plummeted by 2.77%, reaching its lowest level since August 2024. This sharp topple reflects rising considerations over economic stability in the distance, compounded by geopolitical tensions and shifting investor sentiment.

Offer: TradingView

In the US, the S&P 500 shed 4.5%, and the NASDAQ fell 5.5% like minded on the outlet bell on April 3, 2025 (U.S. time). These declines occupy set each indices heading in the correct route for his or her worst trading day since the COVID-introduced about rupture of March 2020. The tech-heavy NASDAQ bore the brunt of the sell-off, as shares of predominant U.S. tech giants admire Apple, Microsoft, and Amazon saw their values erode by 7.5% to 10% within hours.

The S&P 500 most attention-grabbing whipped out $2.5 Trillion worth of worth pic.twitter.com/D81ysmCFo1

— Evan (@StockMKTNewz) April 3, 2025

Analysts attribute this bloodbath to a mixture of macroeconomic fears, alongside side rising inflation expectations and uncertainty surrounding U.S. monetary policy.

Read extra: Crypto Volatiles Intensely following Trump’s Tariff Announcement

Crypto Recovery and Resilience

While mature markets wavered, the cryptocurrency sector showed a noteworthy restoration, defying the broader financial gloom. Several components and explicit segments contained in the crypto home occupy contributed to this resilience, offering a stark incompatibility to the stock market’s woes.

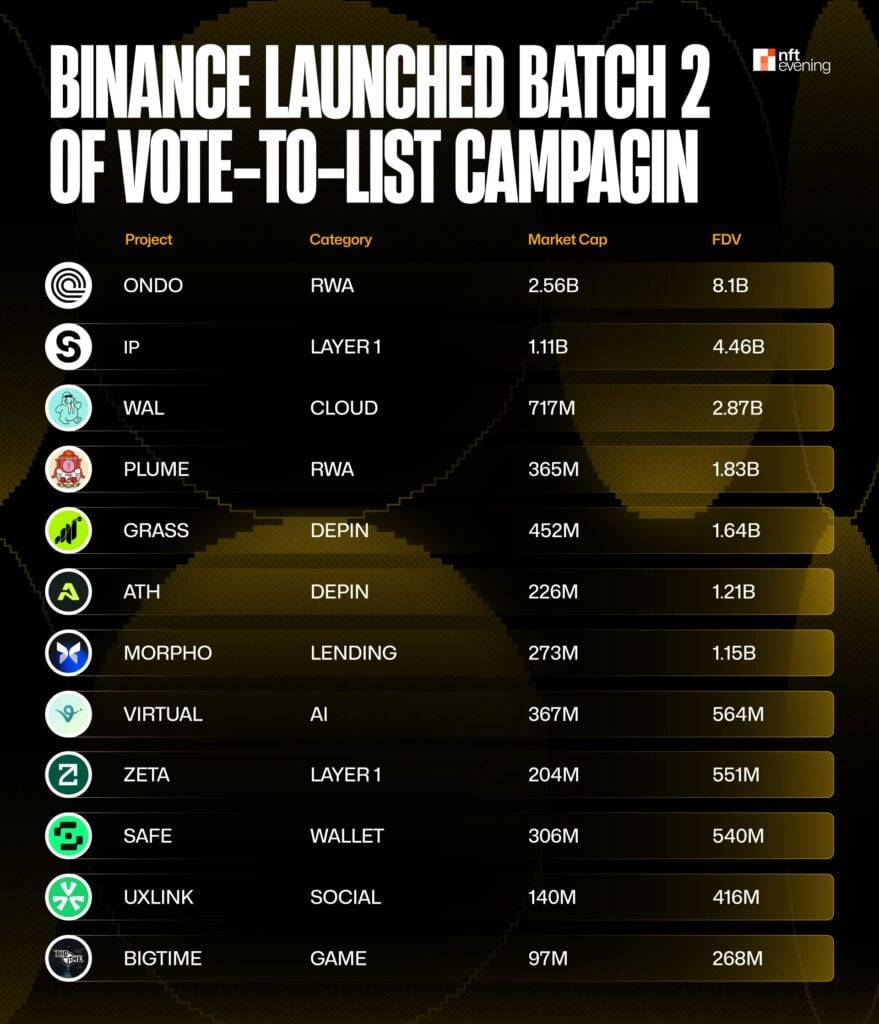

Binance “Vote to List” Personnel Surges

A standout performer in this restoration has been the neighborhood of utility tokens featured in Binance’s 2nd “Vote to List” campaign no longer too long ago. This initiative contains expertise-pushed money such as $VIRTUAL, $BIGTIME, $UXLINK, $MORPHO, $GRASS, $ATH, $WAL, $SAFE, $ZETA, $IP, $ONDO, and $PLUME. These tokens, representing sectors admire AI, DePIN, and Staunch World Resources (RWA), occupy seen indispensable rallies.

As an illustration, $BIGTIME, tied to a Web3 multiplayer RPG, surged by 60% within hours of the announcement, settling at a 30% compose. Similarly, $UXLINK rose 18%, $ZETA 9%, and $PLUME 8%, buoyed by community pleasure and Binance’s influence.

This momentum highlights the rising charm of utility-focused initiatives in a market searching out innovation.

Read extra: Binance Launched 2nd “Vote to List” Batch

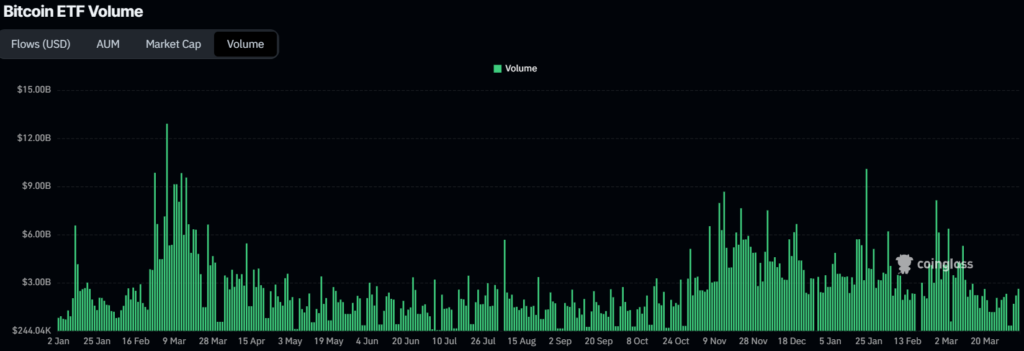

Bitcoin Holds Regular

The head coin, Bitcoin, has demonstrated necessary stability amid the chaos. While stock indices plunged, Bitcoin maintained its ground above key red meat up ranges, avoiding a catastrophic topple. Bitcoin has most attention-grabbing experienced a 1% decrease within 24 hours, holding the worth level of $82,755.

This resilience reinforces its standing as a doable hedge in opposition to mature market volatility, drawing renewed hobby from investors searching out protected havens commence air equities. Despite the actual fact that it hasn’t posted dramatic gains, its potential to “help the line” has bolstered self belief in the broader crypto ecosystem.

Holder’s sentiment additional underscores this stability. Data from Glass node presentations that Bitcoin’s long-timeframe holder (LTH) web feature alternate remains creep, with LTHs accumulating 42,000 BTC all over the final week, signaling sturdy conviction no topic external pressures.

Offer: CoinGlass

Bitcoin’s long-quick ratio shifted to 1 (50.5% long positions) from a a tiny bearish 0.94 closing week, per Coinglass data. This neutralization suggests that BTC holders are holding firm, staring at for clearer signals in resolution to fear-selling. These components collectively highlight Bitcoin’s robustness in the face of macroeconomic turbulence.

Memecoins Gained Traction

The memecoin sector also joined the rally, with speculative tokens utilizing a wave of retail enthusiasm. These money, frequently pushed by hype in resolution to fundamentals, occupy capitalized on the shift in threat speed for food, posting double-digit gains in some cases. Their efficiency reflects the crypto market’s abnormal potential to thrive on sentiment, whilst mature sources falter.

Offer: Cryptorank

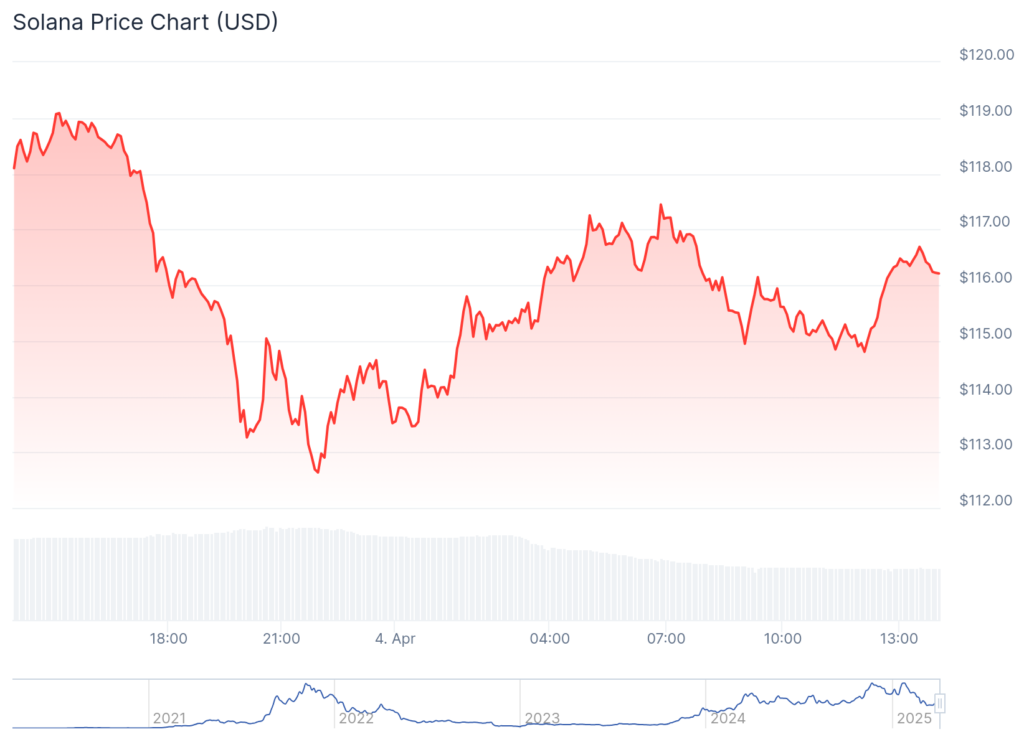

While Memecoins Moon, Solana and Ethereum Flatline

Alternatively, no longer all segments of the crypto market are thriving. Solana and its ecosystem, alongside with Ethereum, occupy remained somewhat stagnant.

The worth of Solana (SOL) has plummeted to its lowest level in three weeks, currently at $115, down nearly 12.75% all over the final 24 hours. In the near future, 1.79 million SOL will likely be unlocked and injected into the market, such as $200 million. This massive influx of SOL would possibly heighten selling stress, in particular because the worth sample grows extra and extra bearish.

Offer: Coingecko

Despite their sturdy fundamentals, each networks occupy struggled to help tempo with the broader restoration. Scalability considerations and market saturation will likely be weighing on investor self belief, leaving them as underperformers in an in any other case buoyant crypto panorama.

In summary, while stock markets reel from heavy losses, the crypto market has staged an spectacular rebound. From Binance’s “Vote to List” stars to Bitcoin’s stability—though Solana and Ethereum remind us that no longer each corner of the home is equally resilient.