Unlocking Opportunity: Key Metrics That Indicate a Crypto Market Bottom, According to Santiment

Of course! Please provide the article excerpt you’d like me to rewrite

Unlocking Opportunity: Key Metrics That Indicate a Crypto Market Bottom, According to Santiment

The crypto market is renowned for its volatility, and with that volatility comes both risk and opportunity. Investors and traders are constantly on the lookout for signs that the market is about to shift. In this post, we delve deep into the key metrics identified by Santiment, a leading crypto analytics platform, that can signal a market bottom. Understanding these metrics not only aids in making informed decisions but also empowers investors to position themselves advantageously as the tide turns.

Understanding Market Bottoms

Before we explore key metrics, it’s vital to comprehend what a market bottom is. A market bottom occurs when asset prices have fallen to a level that is deemed significantly low and indicates potential reversal or recovery. Identifying this point can be crucial for investors looking to accumulate assets before the next bullish trend. However, recognizing a market bottom requires more than mere speculation; it requires analyzing data and trends.

Key Metrics Highlighted by Santiment

According to Santiment, several metrics stand out as strong indicators of a market bottom. Let’s explore these in detail:

- Market Sentiment: The overall sentiment derived from social media conversation analytics can provide insight into investor psychology. When fear and skepticism dominate discussions, it may indicate an oversold market.

- Network Activity: Monitoring the number of active addresses and transaction volumes can signal bullish behavior. A surge in activity often precedes significant price movements.

- Whale Activity: Tracking transactions from large holders or “whales” can reveal market intentions. If whales begin accumulating during price dips, it could suggest confidence in future price increases.

- Funding Rates: When funding rates turn negative, it indicates that traders are overly bearish. This imbalance between longs and shorts can hint towards a potential market bottom.

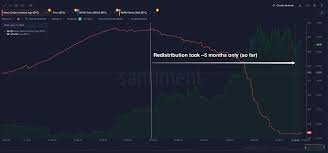

- Supply Metrics: The behavior of supply metrics, such as the percentage of coins held on exchanges versus long-term holders, can indicate investor sentiment. A decrease in exchange-held coins often reflects a bullish trend.

The Importance of Combining Metrics

While each metric provides valuable insight, the magic truly happens when these metrics are combined. A singular focus might lead to misinterpretations. For instance, high whale activity aligned with positive network sentiment could paint a promising picture for price recovery, while a sharp drop in network activity accompanied by negativity in market sentiment could raise red flags.

The Benefits of Identifying a Market Bottom

Understanding the key metrics that indicate a market bottom offers numerous benefits:

- Enhanced Decision-Making: Investors can make more informed buying decisions based on tangible data rather than relying solely on gut feelings.

- Strategic Positioning: Early identification of potential market reversals allows investors to enter at lower prices, maximizing potential gains.

- Risk Management: Recognizing the signs of a bottom helps in crafting better risk management strategies, minimizing losses during market declines.

- Market Confidence: Having a clear understanding of market dynamics can instill confidence, encouraging longer-term investment horizons.

Expert Insights on Market Bottoms

While Santiment’s metrics provide a robust foundation, it’s crucial to remain aware of the broader market context. External factors such as macroeconomic trends, regulatory changes, and technological advancements in the crypto space should also be considered.

For instance, the recent adoption of cryptocurrencies by major financial institutions or regulatory clarity on digital assets could serve as strong underlying catalysts that support a new bull run. Similarly, global economic conditions, such as inflation rates or interest rate adjustments, can significantly influence investor behavior in the crypto market.

Experts often suggest developing a diversified portfolio to mitigate risks associated with crypto investments. Combining fundamental analysis, such as those provided by Santiment, with technical analysis—including chart patterns, resistance levels, and moving averages—can yield a comprehensive strategy for navigating the often tumultuous crypto waters.

Unique Analysis: The Future of Cryptocurrency Investments

As the landscape of cryptocurrency continues to evolve, understanding key metrics that signal market bottoms will grow increasingly vital. With continuous advancements in blockchain technology and broader adoption of digital currencies, the volatility observed in past cycles may shift. Investors must remain adaptable and informed, leveraging both established metrics and emerging trends.

Furthermore, as centralized exchanges introduce new financial products like decentralized finance (DeFi) derivatives and tokenized assets, the interplay between market sentiment and trading dynamics may also shift. Consequently, keeping abreast of new developments will be essential for identifying optimal entry points.

Conclusion: Embracing Opportunities in the Crypto Market

In conclusion, recognizing the key metrics that indicate a market bottom, as identified by Santiment, can provide valuable insights for investors aiming to capitalize on emerging opportunities. As the crypto market continues to mature, the importance of data-driven decision-making will become more pronounced. By harnessing the power of analytics, understanding economic indications, and staying informed about technological advancements, investors can navigate this dynamic landscape with confidence.

For more insights on cryptocurrency and market trends, explore our collection of articles on BizTechLive.

Additionally, for expert analysis on market behaviors and future predictions, consider checking out Forbes’ Crypto Market Research and CoinDesk’s Market Insights.